Sriya Enterprise recently conducted an insightful Trade Finance and FEMA Workshop at SRF Limited in…

Opportunity from Adversary – Rupee Trade Mechanism

Due to the Russian invasion of Ukraine, European Union has prohibited global transactions with Russian entities using euro-denominated banknotes, while the U.S.A. has also stopped access to the U.S. Dollar. This made India, which continues to trade with Russia, consider reviving the Rupee-Rouble mechanism, conceived in 1953 under the Indo-Soviet trade agreement.

Over 40 U.S. and European allies have imposed economic sanctions against Russian banks and entities amid the war in Ukraine. As per Bloomberg, Indian exporters are awaiting payments of about $500 million that have been delayed amid the sanctions.

Adversary always gives scope for new opportunities. Similarly taking a cue from this adversary and reviving the history conceived in 1953 under the Indo-Soviet trade agreement for the Rupee-Rouble trade arrangement. in July, the Reserve Bank of India (RBI) set to revive the same mechanism conceived in 1953 under the Indo-Soviet trade agreement to settle India’s international trade transactions with willing countries in rupees including Russia as an alternative payment mechanism to settle dues in rupees instead of Dollars or Euros.

In order to promote the growth of global trade with emphasis on exports from India and to support the increasing interest of the global trading community in INR. India has started discussions with smaller countries also, who would be interested in exploring bilateral trade through rupee accounts and internationalizing indigenous payment modes.

The Reserve Bank had asked banks to put in place additional arrangements for export and import transactions in Indian rupees in view of the increasing interest of the global trading community in the domestic currency. Before putting in place this mechanism, banks were to acquire prior approval from the Foreign Exchange Department of the Reserve Bank of India (#RBI)

Guidelines

- Invoicing of goods and services: any #export or $import under this plan may be invoiced and denominated in the Indian Rupee (INR).

- Exchange Rate fixing: price discovery of the exchange rate between the currencies of the two trading partner countries may be market determined.

- Settlement currency: The settlement of international trade transactions under this arrangement shall take place in Indian Rupees (INR).

- Indian importers undertaking imports through this mechanism shall make payment in INR which shall be credited into the Special Vostro account of the correspondent bank of the partner country, against the invoices for the supply of goods or services from the overseas seller /supplier.

- Indian exporters, undertaking exports of goods and services through this mechanism, shall be paid the export proceeds in INR from the balances in the designated Special Vostro account of the correspondent bank of the partner country.

Bylaw

Authorized Dealer Bank should ensure the #FATF(Financial Action Task Force) status of its correspondent bank. If a bank from a trade partner company approaches AD Bank to open a special #Vostro account, the AD

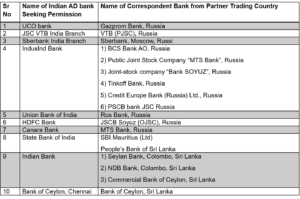

To date, the Government has notified 11 Indian AD banks to whom approval has been granted to open SRVA of correspondent bank/s of the partner trading country as on December 5, 2022.

Tie up with banks in 3 countries currently has been done I.e Russia, Sri Lanka, and Mauritius