About Company

Sriya Enterprise

Sriya Enterprise is an independent Trade Finance advisory firm providing services for various Banking/FEMA/RBI regulation financial products/services including Structured Trade Finance, Conventional funding, Asset & Structured Finance.

Sriya as a Firm is making sincere efforts towards bringing Trade Finance its Regulation and implication to every MSME involved in the business of International Trade. We specialize in Trade Finance and compliance. Our focus is to be an interactive resource to the Client to ensure they have awareness of the ever-changing Trade Finance landscape as their company grows internationally.

About Me

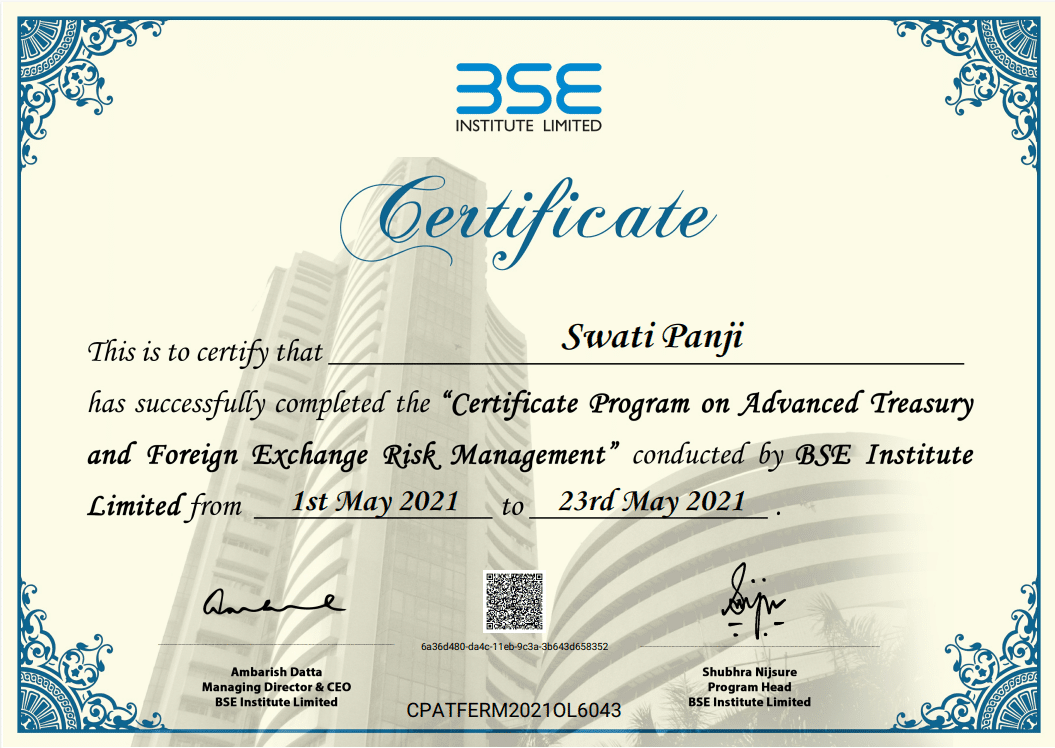

Swati Panji

An ex-banker turned Trade Finance Consultant and Trainer transitioned from a career in banking to specialize in trade finance consulting and training. With a background in banking and a deep understanding of trade finance, i bring a wealth of knowledge and expertise to help businesses navigate the complexities of international trade.

As a Trade Finance Consultant, i provide valuable guidance and advisory services to companies involved in import and export activities. Assist businesses in structuring trade finance solutions, optimizing cash flow, mitigating risks, and ensuring compliance with international trade regulations. By leveraging my banking experience and industry insights gained through 2 decades of banking experience though various roles, responsibilities and geographies. Am able to offer strategic recommendations tailored to the specific needs and goals of their clients.

In addition to consulting, i also serves as a BFSI Trainer, sharing my expertise through workshops, seminars, and training programs. My audienec includes business professionals, bankers, and trade finance practitioners on various aspects of trade finance, including letter of credit, documentary collections, trade documentation, risk management, and trade finance operations. Their training sessions are designed to enhance participants’ understanding of trade finance principles, best practices, and the latest industry trends.

The combination of banking background, trade finance expertise, and training capabilities makes me a valuable resource for companies looking to optimize their international trade operations, mitigate risks, and navigate the ever-evolving landscape of global trade.

My aim is to empower businesses with the knowledge and tools necessary to effectively manage trade finance transactions and drive success in the international marketplace.

Also am associated with some of the start-up firms on International Trade and advisory. Associated with many national and international institutes for conducting webinars and seminars on various topic of Trade Finance, Digitisation in Banking, EDPMS/IDPMS, FEMA and RBI compliance, credit – Commercial Banking

Why

Sriya Enterprise

The export industry is booming like never before in India. The whole world is looking at India to be the next superpower. The world’s big buyers are shifting their focus to #india for their product requirements, and the scale of growth in #exports will be huge traction.

We with our expertise in the FEMA and Trade finance regulations along with new-age avenues of #innovative finance are a single reference point connect.

Our scope of services includes:

What Can we do for you

PO funding options which are non-collateral in nature the manufacturer & traders are looking towards the alternative avenues to raise finance for #procurement, #production #manufacturing, #distribution activity

Pre & Post Shipment #finance is a major propeller for any export business. We can provide solutions be it #bankfinance, #factoring or self-raised funds all contribute to growth.

We have been instrumental in arranging finance for manufacturers & traders in raising #noncollateral finances which gives us the perspective of understanding different types of industries and their requirement

Have been instrumental in advising and handling documentation of highly regulated capital account transactions like Overseas office set-up / Foreign direct investment in compliance with the home country norms and RBI regulations

Mundane looking aspects of the International Trade is the proper updating of Shipping Bill /Bill of Entry records in E/IDPMS, which takes a back seat in the day to day business only coming to foresight on receipt of the regulatory notice.

We at Sriya understand the importance and are ready to take on the regularisation of such activity.