Sriya Enterprise recently conducted an insightful Trade Finance and FEMA Workshop at SRF Limited in…

Mastering Trade: Decoding Incoterms & Payment Terms for Success

Mastering International Trade: Decoding Incoterms and Payment Terms for Export-Import Success

Basically, the need to write this blog came, based on my recent interaction with an MSME exporter. In my recent consultation with an MSME (Micro, Small, and Medium Enterprises) exporter, where I asked him to mention FOC (Free of Cost) for his goods to be exported as sample, he said that it FOB (Free on Board) so how can he mention FOC. it became evident that fundamental concepts in international trade, often taken for granted by seasoned professionals, are not always clear to those directly

When navigating the complex world of international trade, two essential concepts frequently surface: Incoterms and payment terms. Both play critical roles in ensuring smooth transactions between exporters and importers. However, they serve different purposes and are often confused. This blog aims to demystify these terms, highlighting their differences and importance in export-import transactions.

What are Incoterms?

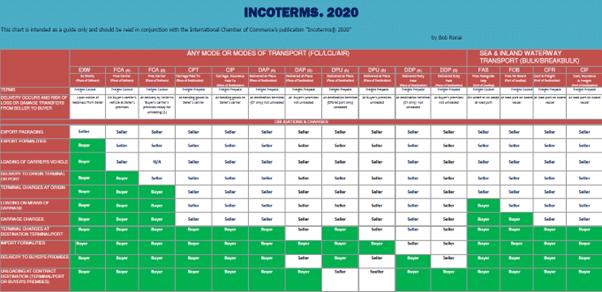

Incoterms, short for International Commercial Terms, are standardized trade terms developed by the International Chamber of Commerce (ICC). They define the responsibilities of buyers and sellers in international transactions, particularly concerning the delivery of goods. There are a total 11 Incoterms as per Incoterm version 2020,

Key Points of Incoterms:

Risk Transfer: Incoterms specify when the risk of loss or damage to the goods passes from the seller to the buyer.

Cost Allocation: They delineate which party is responsible for various costs, such as shipping, insurance, and tariffs.

Delivery Points: Incoterms determine the exact point at which the seller has fulfilled their obligation to deliver the goods.

Most Common Incoterms of the total 11:

EXW (Ex Works): The buyer assumes all risks and costs once the goods are made available at the seller’s premises.

FOB (Free on Board): The seller is responsible for the goods until they are loaded onto the shipping vessel.

CIF (Cost, Insurance, and Freight): The seller covers the cost, insurance, and freight to the destination port, but the risk transfers to the buyer once the goods are on board the ship.

Pictorial of 11 Incoterms

What are Payment Terms?

Payment terms refer to the conditions under which the seller will be paid by the buyer. These terms outline when and how payment will be made, ensuring both parties have a clear understanding of their financial obligations.

Key Points of Payment Terms

Timing of Payment: Specifies when the payment is due (e.g., upon order, on delivery, within 30 days after delivery).

Payment Methods: Defines the method of payment (e.g., bank transfer, letter of credit, open account).

Credit Terms: If applicable, it outlines the credit period and any interest or penalties for late payment.

Common Payment Terms

Advance Payment: The buyer pays before shipment; it minimizes the seller’s risk but requires trust from the buyer.

Letter of Credit (LC): A bank guarantees the buyer’s payment, offering security to both parties.

Open Account: The seller ships the goods and extends credit to the buyer for a specified period.

Key Differences Between Incoterms and Payment Terms

Scope of Application

Incoterms: Primarily address the delivery and transportation of goods, focusing on the logistics and transfer of risk and cost.

Payment Terms: Concentrate on the financial aspects of the transaction, detailing when and how payment will occur.

Purpose

Incoterms: Provide clarity on the responsibilities of each party during the shipment process, reducing misunderstandings and disputes over delivery conditions.

Payment Terms: Ensure both parties have a mutual understanding of payment expectations, enhancing financial security and cash flow management.

Risk Management

Incoterms: Manage the risk of loss or damage to goods during transit by defining when the risk transfers from seller to buyer.

Payment Terms: Address the risk of non-payment by outlining secure payment methods and terms.

Cost Allocation

Incoterms: Allocate costs related to transportation, insurance, and tariffs between the buyer and seller.

Payment Terms: Focus on the timing and method of payment, rather than the allocation of logistic costs.

Conclusion

Understanding the distinction between Incoterms and payment terms is crucial for anyone involved in international trade. While Incoterms clarify the responsibilities related to the delivery and transportation of goods, payment terms ensure a clear agreement on financial transactions. Both are indispensable for mitigating risks, reducing misunderstandings, and fostering smooth and secure trade relationships. By clearly defining these terms in export-import contracts, businesses can navigate the complexities of international trade with greater confidence and efficiency.