India’s international trade landscape continues to evolve, with digital compliance and transparency at the forefront…

India has witnessed a massive push to propel the export growth of the SME and MSME segment through various schemes and FTAs, but their financing needs are yet to be prioritised.

One of the key factors driving growth in the Trade Finance Market is the growing number of exports. The incorporation of technology with trade finance is another factor supporting the trade finance market share growth.

For #exporters to prosper, trade tech and #tradefinancing need to be looked at as their shield for 2023 to steer through a near-recession awaiting the world and boost their sales.

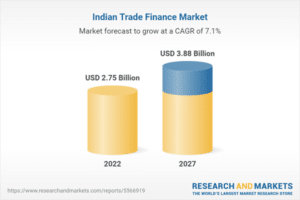

According to a report by ResearchAndMarkets.com, India’s trade finance market is expected to reach $3.88 billion by 2027, growing at a CAGR of 7.1%. Structuring of the #tradefinance for the business growth is very important considering about 80 to 90% of world trade relies on #tradefinance, including trade credit and guarantees, receivables Finance has started becoming core focus of the association and includes Factoring, Invoice Discounting and other Supply Chain Finance solutions Ref. Trade Tech | MSME: A $3.88 billion opportunity: How trade tech & trade finance can guide MSMEs through troubled macros (indiatimes.com)

Factoring, or debtor financing, refers to the process of purchasing a debt or invoice from an organization at discounted prices to allow profits to the buyer upon settlement. It is an asset-based financial arrangement between a financial institution, or a factor, and the client, which states the terms and conditions of exchanging trade debts. Recourse, non-recourse, disclosed, discourse, domestic, export advance and maturity factoring are some of the commonly adopted forms of the process. They relieve the first party off the debts and provides them with the essential working capital to continue trading, while the buyer, or factor, capitalizes on the profits when the debt is paid.

Increasing requirement for alternative sources of financing for micro, small and medium enterprises (MSME) is providing a thrust to the market growth. Factoring enables the business to obtain working capital loans and mitigate credit risks. In line with this, increasing awareness regarding the benefits of supply chain financing, such as factoring, is also contributing factor. The global factoring services market size was valued at USD 3,566.99 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 9.2% from 2023 to 2030.

A rise in open account trading has pushed this segment to grow further, also the importers in developed countries consider factoring, a favorable alternative to conventional methods of trade finance. Besides, growth in international trade awareness and a shift of production facilities especially after the outbreak of COVID-19 from China to other economies such as Vietnam, Mexico, and the Philippines continue to boost the growth of this segment.

Requirement for #tradefinance & #tradecompliance is going to be need of the hour for the times to come and who better than us to be your partner in journey of growth .